Japanese electronics makers were once a dominant force in display and TV production and development before the South Korean competitors entered the market. Now China may take over that role, and lead the era into OLEDs, larger TVs and higher resolution. Are you ready to buy your next TV from a Chinese TV maker?

Once upon a time…

Once upon a time Japanese electronics makers such as Sony, Panasonic, Toshiba & Sharp dominated the TV and display market. You probably remember those days yourself.

Sony is struggling to make the TV division profitable

But in the recent years the balance of power has shifted to South Korean makers. Samsung and LG have both seen tremendous growth with their LCD panel production and TV sales – mainly because they control their own display manufacturing. The South Koreans have also had a more modern approach to product design and have been extremely disciplined in keeping production costs down.

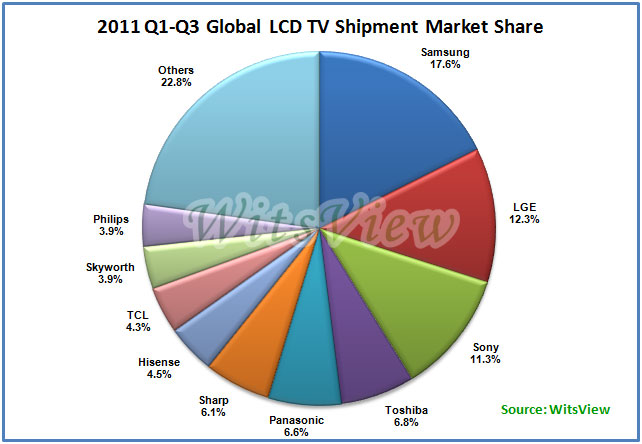

Global LCD-TV shipments in 1. half of 2011, source: WitsView

The Japanese giants are still in the game - but hurt. Sony and Panasonic have lately made several changes to their TV division. South Korean companies are comfortable in their seats but the profit on their display business is only just above break-even. The display market is also very fragmented and display makers sell panels even to their competitors.

Could China dominate the TV and display market in the coming years? China is blossoming and the economy is strong, so we certainly think that it is a possibility. Let us explain why.

China to lead the OLED era?

China – and Hong Kong & Taiwan – is not new to the display game, and changes naturally do not occur overnight. China has had display production plants for years but since the Chinese government has created favorable terms for domestic display makers and invested in the development, the market has taken off. And the shift to the OLED technology could spur the paradigm shift.

AU Optronics is exhibiting this 32-inch OLED-TV right now

Samsung is in the OLED game, LG is too. The future of display technology is OLED and we may see shifts in the balance of power after the shift away from LCD/plasma into OLED. The same thing happened to Samsung and LG back in the early days of the LCD technology.

Chinese Haier has exhibited a TV with wireless power

The Chinese manufacturers seem to agree and are all ramping up OLED production. Samsung is still the largest OLED (Samsung calls it AMOLED) producer but many Chinese makers are investing aggressively. Taiwanese AUO has begun sampling OLED panels to smartphone makers. BOE has begun OLED production at 4.5G & 5.5G lines (a 4-5. generation line is optimized for small-medium size OLED panels), Sichuan has begun production at a 4.5G line, Visionox at a 2.5G and 4.5G line, Xiamen Tianma Micro-Electronics at a 5.5G line and Irico at two 4.5G lines. And larger OLED factories with 7-10G production lines are on the way. But that is not all. The Chinese government is investing aggressively in this new display market.

That is a lot of OLED capacity for smartphones and tablets coming from China in the next few years. And eventually they will take the step to OLED-TV panels.

South Korean LCD makers to enter China

To put it into perspective we need to remember that the LCD technology is still the dominant technology. The LCD production is huge and companies are still expanding their LCD panel capacity. Alongside the OLED expansion, Chinese display makers are also setting up LCD factories to compete in the short-term.

The most interesting fact, however, is the fact that South Korean display makers who traditionally have been setting up LCD plants in South Korean, are now setting up new LCD plants in China.

Taiwanese Chimei Innolux exhibits a 4K LCD-panel

Samsung has just asked for permission to upgrade their coming 7.5G LCD plant that they are building in Suzhou in China to 8.5G. And LG also has plans to set up 8.5G LCD production in China. A third giant in LCD panel production, Taiwanese AUO, has similar plans, and Japanese Sharp is in talks with the Chinese government about a 10G LCD plant. All factories are planned for 2013 but the moves clearly indicate that even the current makers know that China is an important place to be in the future because of favorable conditions and cheap labor force. Also, the Chinese government demands that display makers use their most advanced technologies and production equipment in China to drive innovation.

Meanwhile, Chinese display manufacturers such as BOE and CSOT are initiating “above 8G” LCD production on Chinese land, too. These new LCD factories will make the Chinese LCD makers able to compete with the established LCD panel makers. Tianma – who is also ramping up OLED production – is building lower-generation plants to focus on small-to-medium size LCD panels for handheld devices such as smartphones and tablets. Tianma even believes they can be among global top-3 LCD supplies by 2015 in this area - not exactly a modest statement. One of their competing LCD panel makers, CPT, is also said to be one of the main suppliers of LCD panels for the new Amazon Fire tablet. And Chinese LCD maker BOE recently nabbed the sixth place in global LCD panel shipments; now looking to nab the fifth place from Japanese Sharp. Taiwanese Chimei Innolux (CMI) has also been the top-supplier of LCD panels to Chinese TV makers from several consecutive quarters.

Similarly, China is seeing more and more component makers set up production within the borders of China, with LED production capacity on Chinese ground to explode in the next few years.

The other players

The market is changing rapidly right now, but not only because of the Chinese threat. The global economic situation is not helping. Sony is considering to break out of their LCD-TV panel partnership with Samsung, Panasonic has closed 2 TV panel plants, Philips has recently sold their TV division to TPV from Hong Kong, and Sony, Hitachi and Toshiba has created a joint venture company for small-to-medium size LCD production called Japan Display.

Things are changing and the Chinese hope to take advantage of the new market order.

Are you ready?

As consumers we are seldom aware of what components and display panels power our gadgets but Chinese TV makers are also poised to enter foreign markets with actual consumer TV products if they control the display panel production. Will we see Chinese TV makers enter Europe and the US? Possibly, yes.

Chinese Haier exhibits transparent 222 display, picture from Engadget

The largest TV makers in China are TCL, Hisense and Skyworth but Haier has also been attending the CES exhibition in Las Vegas and IFA in Berlin and received a fair amount of attention with their innovative products. They are becoming too big and relevant to ignore – even if you live nowhere near China.

It does not mean that South Korean TV makers will disappear because Samsung and LG seem to accede to the changing balance of power in the display industry. We are more concerned about the Japanese who seem to be a lot more conservative in their thinking – after all, they let the South Koreans get foothold in the first place.

LCD-TV from Chinese TCL

So, are you ready to buy a Chinese TV next time your living room requires a new altar?

China to dominate future of TVs & displays? ">

China to dominate future of TVs & displays? ">