With the competition between streaming services intensifying, it’s easy to forget there’s still a market of consumers who buy physical media, who like to collect tangible things, for a variety of reasons including pride of ownership, wanting to actually own things, fear of tampering by content owners. Is it niche? Not quite. It’s shrinking for sure, by double-digit numbers annually, but it’s still a mass market. What’s niche perhaps is the premium segment of this market – Ultra HD Blu-ray, a 4K HDR disc format introduced 5 years ago this February, 10 years after Blu-ray Disc and 20 years after DVD. It’s likely the ultimate video disc format.

Nielsen VideoScan, a company of the NPD Group, has since years been collecting retail sales numbers of consumer purchases in the U.S. market. I’ve tracked those numbers the past few years and they show a couple of interesting things.

The year 2020

First a note of caution, though. The past year has not been a normal year for a lot of things, including entertainment spending. Expenditure on streaming services has increased at an accelerated rate while spending on physical media has not. But there’s more. Because of covid measures, Hollywood studios have had to halt movie production for months. Moreover, because of lockdowns cinemas and movie theaters have had to close for extended periods of time. This dearth of theatrical releases has translated into a complete stagnation of home video releases a few months down the line, still observing the traditional windows in the staggered releases schedules. The sell-through video market is, or at least used to be, driven by such new releases. That’s the main reason why 2020 was not a great year for movie sales, and it has exaggerated certain trends.

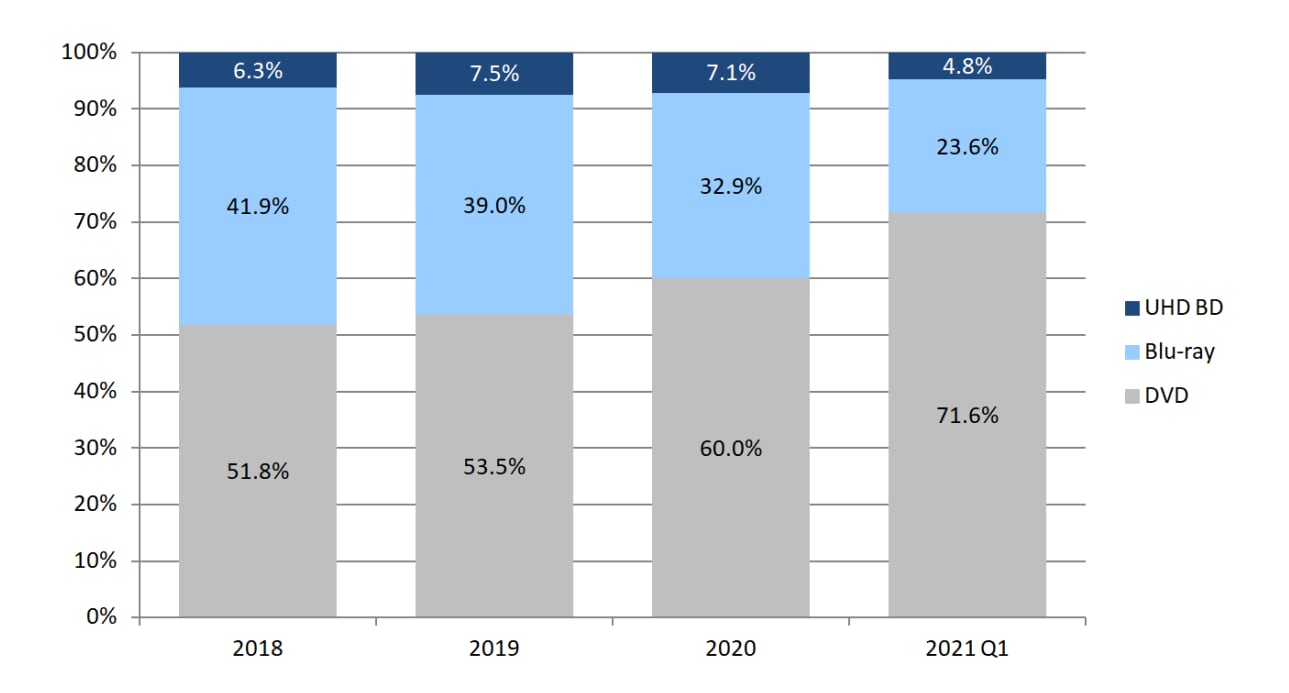

Percentage of units sold, based on weekly data from NPD VideoScan and MediaPlayNews research

The big squeeze

The most interesting trend in my view is what’s happening to Blu-ray Disc, the 1080p HD disc format: it’s getting squeezed between DVD and Ultra HD Blu-ray. It’s clearly visible in 2020 but if you look back a little further you can see this happening more or less from the introduction of UHD BD. The split between DVD and BD was about 50/50 (in units) before UHD BD launched. This was as far as Blu-ray Disc got in trying to displace DVD after reaching maturity. It had been on the market for ten years by then.

This squeeze makes sense, of course. DVD is the cheapest option here, and price does matter. Ultra HD Blu-ray meanwhile is the best format in terms of audio and video quality. Blu-ray Disc is neither. It’s a decent compromise between price and picture & sound quality but it’s neither the cheapest nor the best. It’s less and less a compelling proposition. That UHD BD would mostly cannibalize BD was to be expected: The people who want the cheapest option and still haven’t upgraded to BD more than 10 years after introduction are likely to stick with DVD while those who want the best quality migrate from BD to UHD BD.

Every week when I post the weekly market share pie chart on my UltraHDBluray tweet feed, someone – in shock about the high market share of DVD – will ask “who still buys DVDs?” Well, a lot of people, is the answer. And who can blame them? Evidently the movie business and CE industry have not done a good job educating people about the differences between DVD and BD (never mind UHD BD) and persuading them to go for the premium option. These differences go further than just image resolution. Take frame rates for instance. Most DVDs contain interlaced video. The format can support progressive video but not at the 24fps frame rate that most movies are shot at. (For an explanation of the importance of frame rates, see this article on HFR.) Dolby Atmos sound and its competitor DTS:X are exclusive to Blu-ray Disc and its 4K sibling, though much more common on the latter. And naturally 4K resolution and HDR (High Dynamic Range) video are only available with Ultra HD Blu-ray.

| DVD | Blu-ray Disc | Ultra HD Blu-ray |

|---|

| Video resolution | 480i SD | 1080p HD | 2160p 4K (progressive) |

| Frame rate (fps) | 60i (interlaced) | 24p (progressive) | 24p (progressive) |

| Dynamic range | SDR | SDR | HDR |

| Typical audio | Dolby Digital or DTS | Dolby Digital Plus, TrueHD, DTS-HD | Dolby Digital Plus, TrueHD, Dolby Atmos, DTS-HD or DTS:X |

| Typical retail price | $10 | $15 | $25 |

The in-between $20 price point is more or less reserved for 3D Blu-rays, though these have become rare

Another reason for the continuing success of DVD is that while just about everything gets released on DVD, that’s not the case with Blu-ray (let alone 4K). Nowadays, many TV series – even those that were broadcast in HD – are released only on DVD, not on BD. As for Ultra HD Blu-ray, many new movies get a release on the format but TV series rarely do. Also Netflix originals that are shot and streamed in 4K – series like

House of Cards,

The Crown,

Jessica Jones and

Daredevil – get a BD release at best. The only exception to that rule so far has been

Stranger Things, but that 4K disc release has been a retailer-exclusive only available through U.S. chain Target.

Some Ultra HD enthusiasts frequently suggest that movie studios should stop releasing DVDs, apparently thinking that consumers would then upgrade to higher-quality formats. I don’t expect that would happen. The cost-conscious DVD buyers would more likely switch to streaming options. Studios would be crazy to stop the cash cow that DVD still is. And it provides essential volume for the optical disc replication plants, of which there are fewer now than during the peak days of CD and DVD, to keep running at a decent load.

The outlook

The modest rise in market share for Ultra HD Blu-ray will likely resume when blockbuster titles are getting released again and movie business returns to normal. The best weekly market share for the format so far was when

Avengers: Endgame was released:

20%. Blu-ray Disc did nearly 50% that week – also a great score. Major titles have been few and far between since the pandemic struck. The only real tentpole title has been

Tenet. It sold

38% in 4K in its premiere week (pushing the format’s market share to 6.6% – above average for 2020) and around 25% in the weeks following.

There are some highlights coming up. Pixar’s

Soul was released in late March, followed the week after by

Wonder Woman 1984 and in May we can probably look forward to a home video release of the much anticipated

Zack Snyder’s Justice League, preceded by a remastered edition of

Batman vs Superman: Dawn of Justice from the same director. Also expected shortly is

Godzilla vs Kong.

The first week of Q2 is already looking better than any week in Q1 did, with

8.8% market share for Ultra HD Blu-ray. That's based on just a single week though, so let's not get overexcited yet.

Some studios have logically shifted their attention to reissuing back catalog titles in 4K, though perhaps not as much as one might have expected. The

Lord of the Rings and

The Hobbit Trilogies were reissued on Ultra HD Blu-ray late 2020, apparently somewhat sooner than initially planned. In Q2 we can look forward to a box set of all the

Indiana Jones movies remastered in 4K HDR.

The hardware

The hardware market indicates that Ultra HD Blu-ray is a stable niche. The number of

players sold is shrinking slightly. It’s also telling that while Samsung has actually withdrawn from the disc player market altogether, the other major CE brands Panasonic, Sony and LG have not introduced new models lately and continue to sell existing models, apart from the just announced Panasonic DP-UB9000

Mk II. Cheap, low-end, no-brand competition from China, that became massive with DVD, has not entered this market. Instead we’re seeing high-end boutique brands entering, again indicating this market is becoming a premium collectors business rather than a mainstream one. Industry watchers also predict a wave of ‘clones’ of the beloved universal disc players that Oppo made.

Reavon universal disc player

The console factor

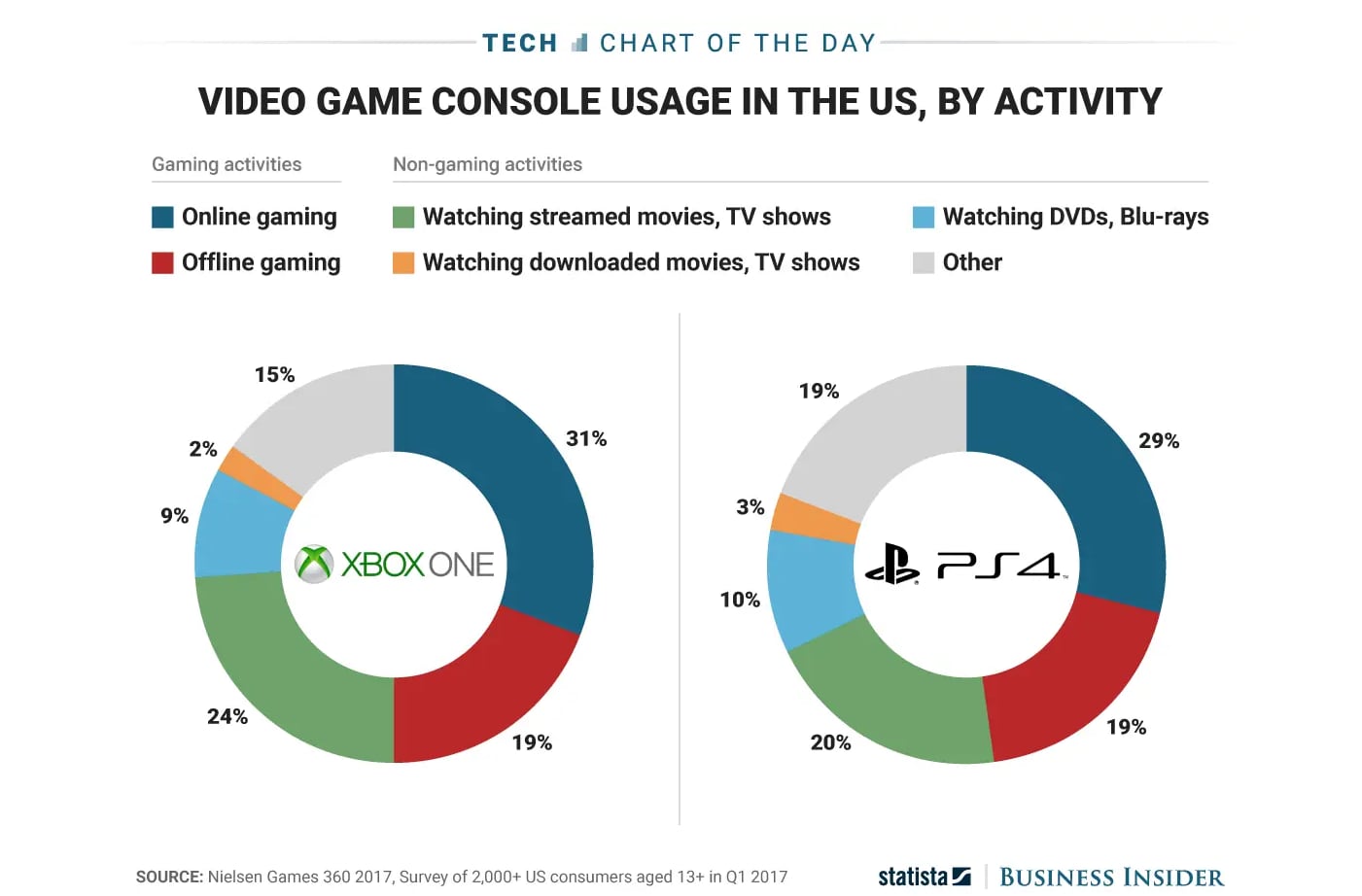

The installed base of UHD BD-capable players is sure to rise massively this year thanks to the introduction of PlayStation 5 and Xbox Series X. Discless “digital-only” versions of both consoles exist – the Microsoft one is called Xbox Series S – but millions of players will be in households in the course of this year. These devices are foremost games consoles but

statistics show that console owners use the devices for many forms of entertainment including music, movies and series. A lot of that may happen in the form of streaming but the option is there. Will this impact the sales of movies on Ultra HD Blu-ray a lot? Not before major movies see releases on home media again. Once that returns to normal we may see higher volumes of discs selling than before.

Pure games consoles? Not quite. Source: Business Insider

At the moment, the worldwide Ultra HD Blu-ray Disc market is worth roughly 1 billion dollars, the majority of it in North America. That may be a niche in the overall entertainment business but it's a sizeable niche with healthy margins. May it live long and prosper.

A few notes about the bar graph

- The chart represents retail sales in units – not in value. Given the much higher selling prices of UHD BD compared to BD and especially DVD, the distribution looks much more skewed than it is. In value, the chart would look far more balanced.

- The numbers are a simple, unweighed average of the weekly numbers because VideoScan only publishes the breakdown, not the volume or value. This also distorts the picture because in weeks with major title releases the share of BD and UHD BD is much higher and so the overall volume. This should be reflected but because the data is lacking, DVD is also overrepresented here.

|

FlatpanelsHDYoeri Geutskens works as a consultant in media technology with years of experience in consumer electronics and telecommunications. He writes about high-resolution audio and video. You can find his blogs about Ultra HD at

@UHD4k and

@UltraHDBluray.